Budgeting your money can be a difficult thing to do. A lot of people are finding it hard to budget their money and live on a fixed budget throughout the weeks and months. Yet, if you know what you should be truly spending your money on, and you know how to save money it really isn’t that hard. Sometimes you just need a little reinforcement of what you should be doing to save money. That’s where this article comes in, it is going to help reinforce what you should think about to budget your money.

Make a list of all the money that comes in to your house. This includes your spouse and anyone else that is an adult that may be living with you. You then want to calculate how much everyone should be paying for rent and other bills and make sure that everyone is paying their fair share. Do not think that it is your responsibility alone to pay all of the bills in your home, if you aren’t the only adult living there. You also want to make sure everyone is equally contributing to your home. By doing this you lighten your load to help you manage your finances.

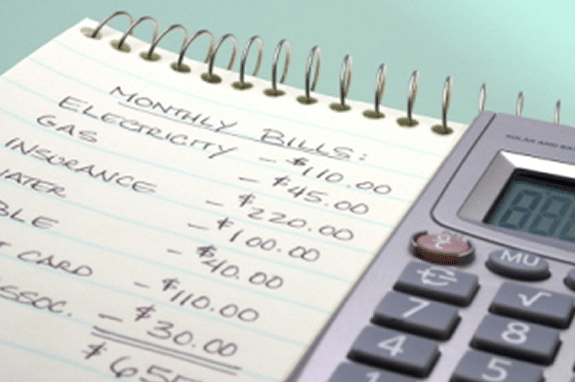

How to Make a Personal Weekly Spending Budget

Buy things on sale when you do make purchases, and set a weekly spending budget for yourself. Far too many people do not set a weekly budget for themselves and this hurts their finances in the process. You want to make sure that you are doing the right thing and that you are not spending a lot of money on things that aren’t a necessity for you. When you set a weekly budget for yourself you help give yourself something to go buy when you spend money. Avoid going over this budget because it is going to put you in a financial bind.

Buy things on sale when you do make purchases, and set a weekly spending budget for yourself. Far too many people do not set a weekly budget for themselves and this hurts their finances in the process. You want to make sure that you are doing the right thing and that you are not spending a lot of money on things that aren’t a necessity for you. When you set a weekly budget for yourself you help give yourself something to go buy when you spend money. Avoid going over this budget because it is going to put you in a financial bind.

If you need a little extra money, then sell some things that you do not need anymore. You can make a good amount of money if you have a garage sale. You can get rid of things that you do not use anymore or that you have stored in your closet. Just make sure that everyone is comfortable with everything that you sell in your home. You do not want to get anyone mad by selling items that they had stored for a particular reason.

Set up a weekly spending limit on gas. Since gas is going up in price, you want to make sure that you are not spending too much on gas. A good way to make sure that you do not do this is to set up a weekly gas budget, and if your tank is a little lower than usual at a particular time, then tell someone else to drive or don’t go out. You have to make cuts here and there and gas is one of the places where you can make a lot of good cuts.

Get your life on the right track and budget your money properly. Do not neglect what you learned today, because overlooking the information that you learned today can make you waste a lot of money.