Saving Money

Spending money is the biggest problem with maintaining your finances. It is impossible to not spend money monthly on basic necessities and nearly impossible for most people to not spend on frivolous things. However, if you can tweak your necessities and tailor your budget to include money for your wants, you can find a comfortable balance that doesn’t leave you feeling like you are sacrificing the present in order to have a future.

Spending money is the biggest problem with maintaining your finances. It is impossible to not spend money monthly on basic necessities and nearly impossible for most people to not spend on frivolous things. However, if you can tweak your necessities and tailor your budget to include money for your wants, you can find a comfortable balance that doesn’t leave you feeling like you are sacrificing the present in order to have a future.

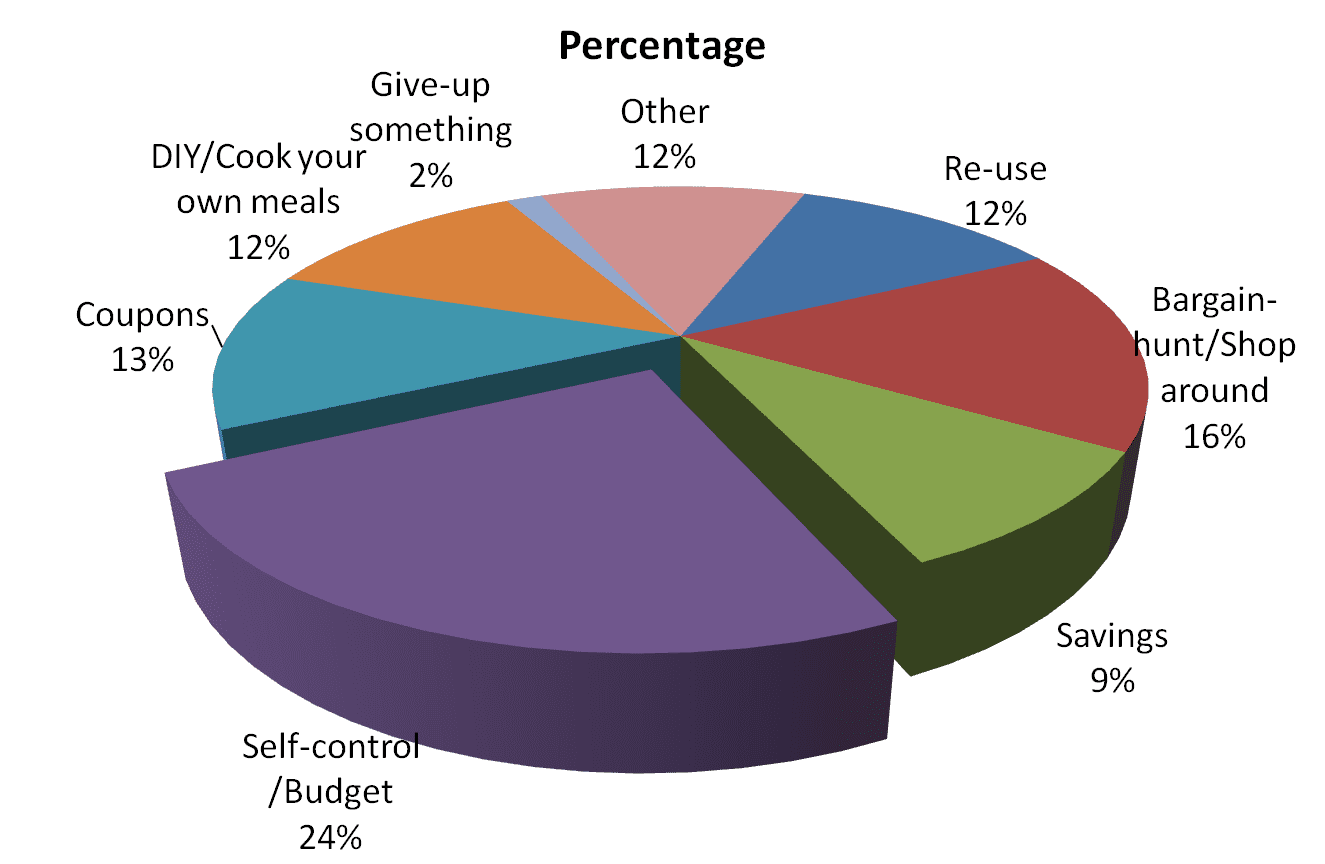

A great way to increase savings is through multiple small savings. Surprisingly enough, many of these small savings can come from the necessary side of the budget. The fallacy that many budget newbies are under is that what you spend on necessities is necessary. When you are at the grocery store, do you make an effort to price watch and compare to the point of saving dollars at checkout? If you don’t, you should. There are now more options for saving money on food through sales, coupons and generic brands. Saving $10 on groceries every trip adds up over time. Look for monthly needs that can be trimmed this way, such as your cable, phone or cellular services.

Another resource that is important to you is your control of your payroll. With direct depositing, you can not only have your check go straight to the bank, thus taking it from your hands, but also have it split between a checking account and savings. As you direct the flow of your funds to these two areas, you should also direct some into your hands. By giving yourself a weekly spending allowance, you control the amount you have for frivolous spending, like lunch at work when you just don’t feel like packing a lunch. When you designate your saving money this way, you feel in control from the beginning. Granted, you can still spend your way through every check if you are not prudent; however, feeling that control in the beginning will add confidence to your budget efforts each week.

A third trick for budgeting is to build anticipation for purchases. If there is something in your mind that you must have, then you probably know about it before you have to have it. Prepare for upcoming expenditures by saving towards it as far in advance as possible. When you wait till the last minute to purchase something new, you are giving into your instant gratification needs, and you will feel like an impulse shopper, thus creating a negative feeling about it.

The final thing to remember is this: saving money takes control. Track where it goes as it comes in, and you will more easily watch where it is going. As you begin your journey to better personal finance, you will experience growing pains of course, but you will also experience the joy of building towards a future. Set goals for your savings, and remember that it is not a slush fund when you want to have a spending spree. Your spending sprees are possible if you stay current with your needs and trim the fat from your spending.