Everyone feels the strain on the pocketbook these days. People are getting laid off and not able to find good jobs. Prices of consumer goods keep going up. Gas prices are at their all time high. A lot people are in deep debt and filing for bankruptcy. You may feel like it is impossible to save money. However, there are ways that you can shave off expenses in your everyday spending that can add up to a fair amount. It will require some discipline and a different way of looking at things. If you want to learn more about how you can save money in this tough economy, read this article for advice that you can use.

How To Save Money In This Tough Economy

Money can be saved by making some adjustments in the things that you pay for everyday. For example, do you usually buy coffee everyday, perhaps two or three times a day? Depending on where you buy your coffee and how much you spend per cup, you can spend anywhere from $5 to $10 just for a few cups of coffee everyday. If you do not buy your coffee, but bring your own, imagine saving up to $10 everyday. That is $50 a week, or around $200 a month. Carry that out further and it can be about $2400 a year. That can be a nice sum to put into a savings or retirement account.

Money can be saved by making some adjustments in the things that you pay for everyday. For example, do you usually buy coffee everyday, perhaps two or three times a day? Depending on where you buy your coffee and how much you spend per cup, you can spend anywhere from $5 to $10 just for a few cups of coffee everyday. If you do not buy your coffee, but bring your own, imagine saving up to $10 everyday. That is $50 a week, or around $200 a month. Carry that out further and it can be about $2400 a year. That can be a nice sum to put into a savings or retirement account.

What about lunch? Do you like to go out to eat with your co-workers? A typical lunch can set you back another $10. Doing the same math as you did with your coffee, that is another $2400 a year that you can save per year if you pack your own lunch from home. If you bring your lunch just half the time, that can still save you $1200 a year. Along the lines of food, if you also buy snacks during the day, bring some snacks from home instead. Take along some crackers or fruit, or a couple of cookies. This will cost a lot less than buying a snack at the snack bar.

Think about what types of subscriptions or memberships that you have, and ask yourself if you are making the most of them. For example, if you have a gym membership and you only go one or two times a week, you should consider canceling it. Learn other ways to exercise that do not cost anything, like jogging or biking. If you want resistance training, buy some dumb bells and learn some weight routines. That would be much cheaper than using a weight machine at the gym.

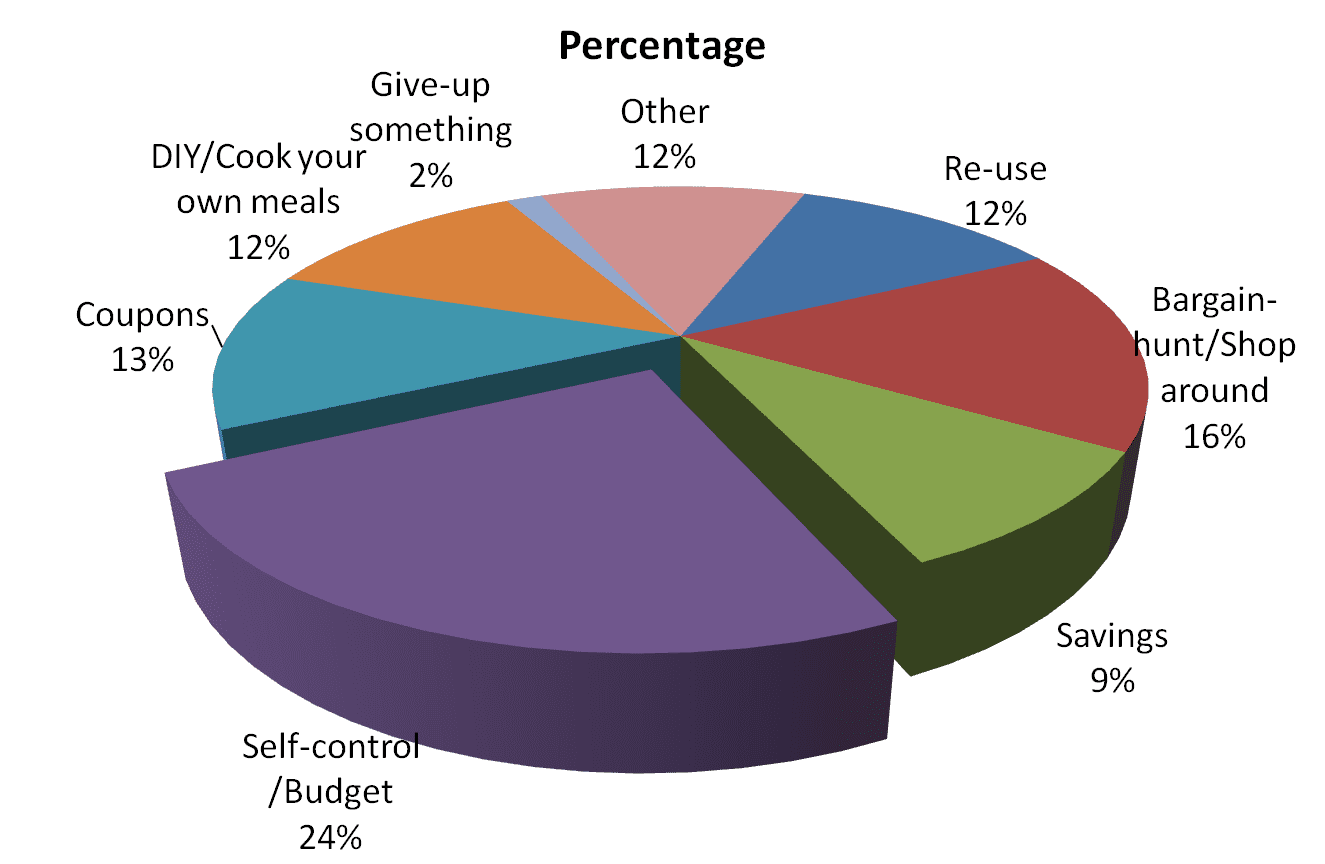

There are many ways like these to save money. Saving a little bit everyday can add up to a big amount. On a piece of paper, just write down the things that you spend on which are not necessities in your life. Think about reducing these expenses or substituting them with a cheaper alternative. If you can be creative and get into that mindset, you can save a good sum of money in no time.